Oppenheimer Ordered to Repurchase $5.98 Million in Auction Rate Securities

(Jan 2012)

In January 2012, a Financial Industry Regulatory Authority arbitration panel in New York ordered Oppenheimer to repurchase certain Auction Rate Securities sold to Claimant Nicole Davi Perry for $5.98 million, plus payment of $134,108 in legal fees. The award was posted in FINRA's arbitration database this Monday. See this related report from Reuters. Dr. O'Neal at SLCG testified on behalf of the Claimant; Dr. O'Neal and Dr. McCann have authored a report on ARS previously.

Auction rate...

FINRA Regulatory Notice: Complex Products

(Jan 2012)

FINRA recently released Regulatory Notice 12-03: Heightened Supervision of Complex Products, outlining their increased scrutiny of a wide variety of alternative investments including structured products, inverse or leveraged exchange traded funds, and asset-backed securities. Here at SLCG, we've done research on each of those subjects, and have a variety of ongoing projects that bear directly on the issues highlighted by the Notice.

The products identified include:

Structured products: 2011 year-end market review

(Jan 2012)

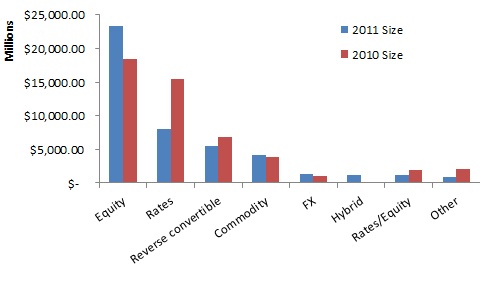

2011 was another big year for structured product sales both in the US and abroad. According to Bloomberg's year end totals, almost $45.5 billion worth of SEC registered structured products were sold in the US in 2011, down only slightly from $49.4 billion in 2010. There were 7,293 individual products sold, up from 6,443 a year earlier.

The number of products linked to interest rates decreased, which was made up for with increases in products linked to equity assets.

Sales in Europe grew...

What are 'structured products', anyway?

(Jan 2012)

By Tim Husson, PhD

We've done a lot of work on structured products. And I mean a lot. In addition to our research on valuation and suitability issues, we've devoted a section of our website to informing investors about different types of products, as well as Tear Sheets evaluating several thousand structured products released over the past couple years. We have found that most structured products are issued at a substantial premium, and that many investors (especially retail investors) do...